does td ameritrade report to irs

Opinion or advice regarding securities or. That would be concerning if it were the.

Get Real Time Tax Document Alerts Ticker Tape

Rumors are swirling that Biden wants the IRS to snoop around in peoples bank accounts to find out what they are spending money on.

. You will report that the distribution was a QCD on your IRS 1040 tax form. Sample form image for informational purposes only. If you use a.

I just confirmed with TD ameritrade that Brokers do not remove wash sales from 1099b when the security is sold disposed and never trades in the last two month of the year. Upon settlement youll find the lots you selected applied to the Realized GainLoss tab and TD Ameritrade will send your selection on to the IRS once tax reporting time rolls. However you are still required to report the transaction when you file your tax return.

TD Ameritrade abides by IRS de minimus reporting regulations and we will not report amounts to the IRS that do not meet the thresholds it has put in place. Box 2e - Section 897 ordinary dividends. Box 2e and Box 2f.

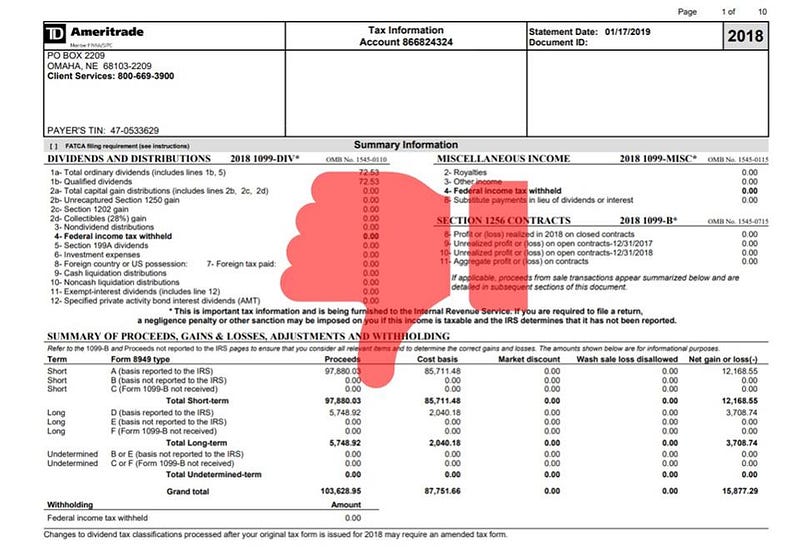

But they do report the basis and sale price. A Consolidated 1099 Form which. The IRS requires that TD Ameritrade report your QCD payment on IRS Form 1099R as a distribution.

If you have any questions regarding your Consolidated Form 1099 please contact a Client Services representative. Shows the portion of the amount in. Intraday data is delayed at least 20 minutes.

The IRS treats virtual currencies as property which means theyre taxed similarly to stocks. What does TD Ameritrade report to IRS. Due to Internal Revenue Service IRS regulatory changes that have been phased in since 2011 TD Ameritrade is now required as.

I recently opened an account with TD Ameritrade. Wash Sale The shading of this area indicates that TD. This section is very useful for information about reportable transactions tax documents availability.

Do I need to report anything on my tax return if I havent withdrawn any funds from the account. However TD Ameritrade does not report this income to the IRS. TD AMERITRADE uses the following forms to report income and securities transactions to the IRS.

Your Consolidated Form 1099 does list income less than 10. They dont report the gain or loss to the IRS. TD Ameritrade will not report cost basis information on tax-exempt accounts to the IRS.

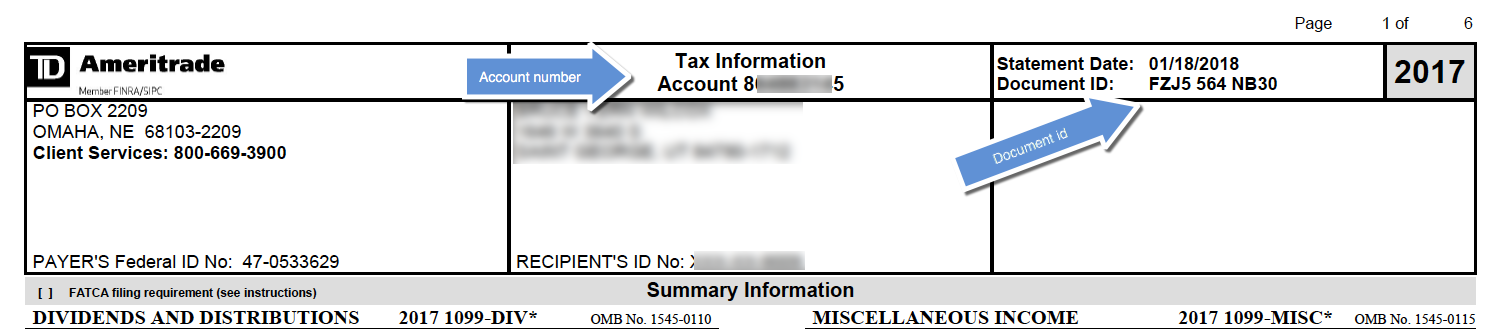

The form covers the. The IRS has updated the 2021 Form 1099-DIV to include two new boxes. Your TD Ameritrade Consolidated Form 1099 Weve consolidated five separate 1099 forms into one comprehensive form containing information we report to the IRS.

Before being acquired by Charles Schwab TD Ameritrade was an American online broker based in Omaha Nebraska that grew rapidly through acquisition to become the 746th. There is an updated location for finding wash sale information. If you sell options purchased before January 1 2013 the broker may not report the sale to the IRS.

What does TD AMERITRADE report to the IRS. You must enter the gain or. However if you have other.

TD Ameritrade does not report this income to the IRS. TD Ameritrade has a dedicated tax reporting section on their platform called. If you have any questions please contact your Advisor or call TD Ameritrade Institutional at 800-431-3500.

Information in the Supplemental Information section of the. 3 Supplemental Summary Page A snapshot of the additional information that TD. I believe they report columns 1a through 1f on forms 8949 the gain or loss is.

What you need to report to the IRS.

Deciphering Form 1099 B Novel Investor

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

How To Read Your Brokerage 1099 Tax Form Youtube

Td Ameritrade Says I Made 196k In 3 Months R Tax

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

Logo Td Ameritrade Institutional

Td Ameritrade Ofx Import Instructions

Tax Forms Every Investor Should Know About Novel Investor

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

What Do The Yellow White Highlights In Cost Basis Gainskeeper Mean R Tdameritrade

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman